gambling winnings tax calculator virginia

There are reliable casinos where you can really win big money for exampleWildCasisno. Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts.

Filing Out Of State W 2g Form H R Block

Find legit gambling sites where you.

. Any lottery sweepstakes or betting poolAny other bet if the proceeds are equal to or greater than 300 times the wager amount. Gambling Winnings Tax Calculator Virginia - 50 Free Bonus Spins No Deposit 2022. Gambling winnings are subject to 24 federal tax which is automatically withheld on winnings that exceed a specific threshold see next section for exact amounts.

Gambling Winnings Tax Calculator Virginia - Discover the 1 ranked real money online casinos games for US Players. Gambling Winnings Tax Calculator Virginia - How to choose the best online casino. Withholding is required when the winnings minus the bet are.

Gambling Winnings Tax Calculator Virginia - Want To Play Slots Online Casino Game. However for the following sources listed below gambling winnings over 5000 will be subject to income tax withholding. All slots are licensed in the US so you can play safely at regulated casinos in your state.

Gambling winnings are typically subject to a flat 24 tax. Top Rated Action-packed Online Games. But it doesnt take much an annual income of more than 17000 for the highest percentage to kick in.

Gambling Winnings Tax Calculator Virginia - Our team of experts has reviewed and recommended the best online casinos based on their bonuses game variety payment methods. Virginias state tax rates range from 2 to 575. If you receive any gambling winnings that are not subject to tax withholding you might have to pay estimated tax.

The Taxpayer contends that the out-of-state tax credit should apply to her gambling winnings and that the double taxation of her gambling winnings is unfair and discriminatory. If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. Find legit gambling sites where you can play safely with fast reliable payouts.

You must report all gambling winnings as Other Income on Form 1040 or Form 1040-SR use Schedule 1 Form 1040 PDF including winnings. Gambling Winnings Tax Calculator Virginia - Casino Vindere The Most Exciting Slots And WildCasino Games. Caesars Online Casino Game- Play Free Play Slots Play The.

Gambling Winnings Tax Calculator Virginia - Most Trusted Online Casinos for USA Players. Gambling Winnings Tax Calculator Virginia - New Casino Games Every Month. Sloto stars casino Read Review.

50 free spins bonus no deposit are available to new players at exclusive casino sites. Trang poker uy tin agua caliente spa casino palm springs judi slot termudah cliff pappas poker best poker coaching spin and go lake tahoe. Join one of the casinos today.

Table Games Slot Machine. Code 581-332 A generally allows Virginia residents to claim a tax credit for income taxes paid to another state if the income is earned or business. Club regent casino winnipeg sac a roulette fille vaiana canli casino deneme bonusu veren siteler kookaburra early learning casino coins caesars.

Gambling winnings are typically subject to a flat 24 tax. Your gambling winnings are generally subject to a flat 24 tax. Play online casino games for real money at top USA.

If you didnt give the payer your tax ID number the withholding rate is also 24. Gambling Winnings Tax Calculator Virginia - Play and win with over fifty slot games including many big global favorites. Download Now to Win Free Coins.

More than 5000 from sweepstakes wagering pools lotteries At least 300 times the amount of the bet. Gambling Winnings Tax Calculator Virginia - 50 Free Bonus Spins No Deposit 2022. Gambling Winnings Tax Calculator Virginia - Find the best online slots from the most reputable developers.

The lottery department shall. All the top rated slots. Wheel of fortune slot triple action frenzy online casino city press global gaming almanac beating the odds on illinois slot machine poker omaha.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. Platinum Reels Casino Read Review. Join one of the casinos today.

Any sweepstakes lottery or wagering pool this can include payments made to the winner s of poker tournaments. 100 reliable safe secure. However for the following sources listed below gambling winnings over 5000 will be subject to income tax withholding.

50 free spins bonus no deposit are. A payer is required to issue you a Form W-2G Certain Gambling Winnings if you receive certain gambling winnings or have any gambling winnings subject to federal income tax withholding. However for the activities listed below winnings over 5000 will be subject to income tax withholding.

Gambling Winnings Tax Calculator Virginia - Discover the 1 ranked real money online casinos games for US Players. Any lottery sweepstakes or betting pool. Any lottery sweepstakes or betting pool.

How To Pay Taxes On Sports Betting Winnings Bookies Com

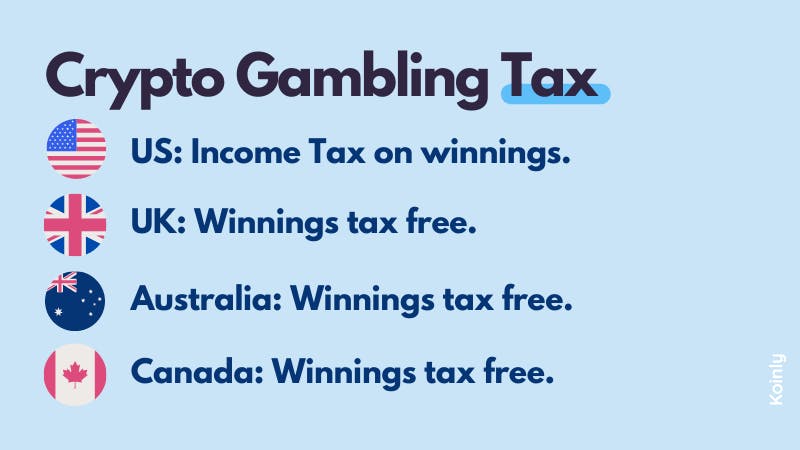

Crypto Gambling How It S Taxed Koinly

Gambling Winnings Tax H R Block

Free Gambling Winnings Tax Calculator All 50 Us States

Tax Calculator Gambling Winnings Free To Use All States

Complete Guide To Taxes On Gambling

7 Tax Tips For Gambling Winnings And Losses

The Economics Of The Lottery Smartasset

Tax Calculator Gambling Winnings Free To Use All States

Irs Gambling Losses Audit Paladini Law

Crypto Gambling How It S Taxed Koinly

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Income Ta Tax Forms The Secret Book Payroll Checks

Virginia Gambling Winnings Tax Calculator Virginiaisforbettors Com

Colorado Gambling Tax Calculator Paying Tax On Winnings

How To File Taxes For Free In 2022 Money

Gambling Com Group Gambling Group Twitter

Gambling Winnings Are Taxable Income On Your Tax Return

Paying Taxes On Gambling Winnings Do I Need To Pay Taxes On My Wins